Since the beginning of President Trump’s campaign, he has continuously claimed that tariffs were the solution to many of the United States’ economic problems. After much debate and back-and-forth, the Trump Administration bit the bullet and chose a day to make an announcement. On Wednesday, April 2, he appeared before a group of union members to announce his new tariff plans. The Trump administration claimed that this was done to bring manufacturing and jobs back to the US and “Fix” trade deficits. However, the reaction has been shock and fear among politicians, economists, the media, and, most importantly, the markets.

In the immediate aftermath of the monumental announcement, the US saw a massive market downturn, with the DOW tumbling nearly 5,000 points within the week, marking an all-time record collapse. This led to widespread talk of a recession and increased fears of an economic collapse. All this has massively increased pressure on the Executive Branch despite their claim of loyalty to the idea of keeping the tariffs in place. On April 9th, only a week after the original announcement and market disaster, Trump announced a pause on reciprocal tariffs for 90 days, except China’s tariff, which was raised to 125%.

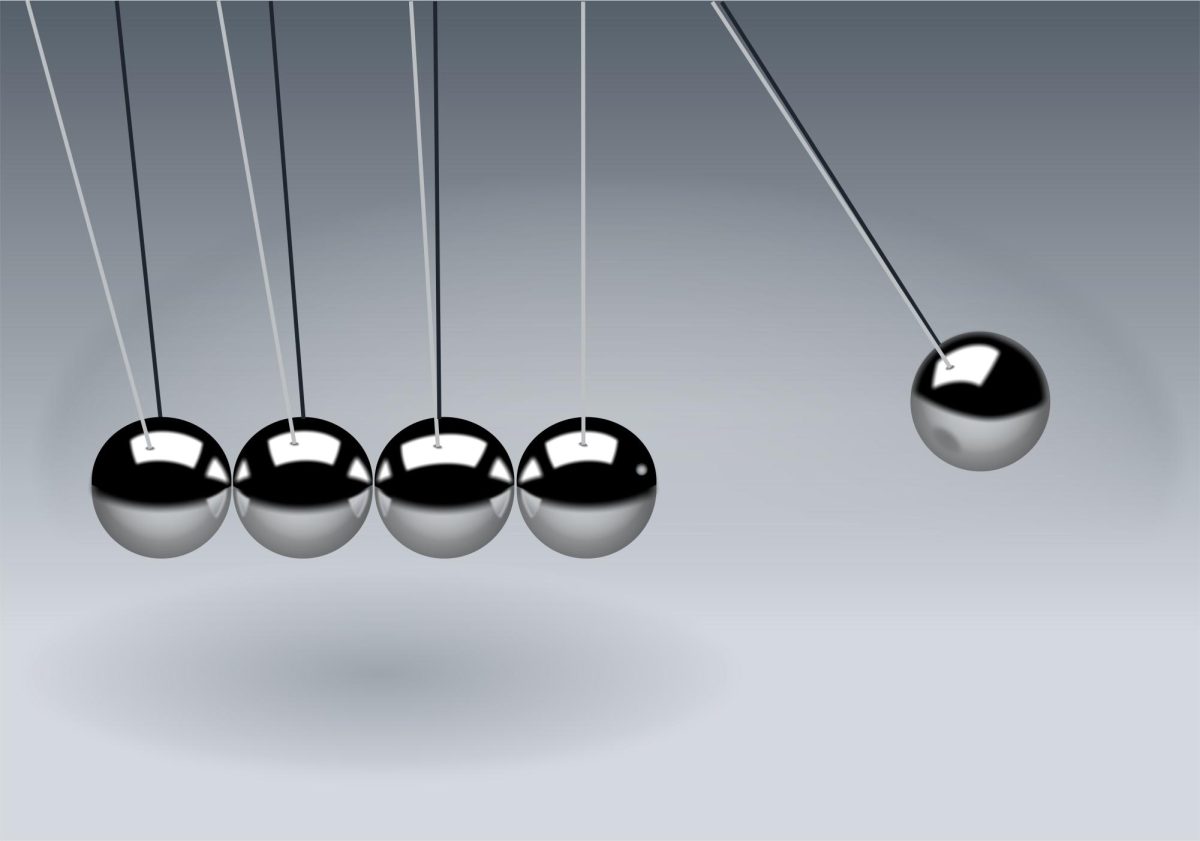

After this announcement, markets climbed enough to make up a majority of the losses while remaining net negative. China and the US are still in a stalemate; the parties are essentially playing a game of chicken, waiting for the other to come to the table first. Trump has started to eliminate tariffs on goods like smartphones and other electronics, which may indicate a willingness to concede more ground or come to the table for an agreement. While it is difficult to predict what the Trump administration’s next move may be, they generally seem to be backing off the extraordinarily aggressive stance they came out with on “Liberation Day.”

However, recession fears are not gone, nor is market volatility. On April 21st, the market fell nearly 1000 points as Trump and Jerome Powell, head of the Federal Reserve, publicly feuded over interest rates. This was followed by a four-day climb of nearly 1,000 points, but this highlighted the markets’ continued instability. Many lie in wait for the 90-day deadline on tariffs, which is to come during the summer and its inevitable effects on the markets once they take place. Many believe that these jumps and dives from the market are the first indications of a large economic crisis.

Generally, it could be said that these unstable markets are indicative of unstable times as the political and economic spheres experience continued volatility. The markets are still largely in uncharted territory, as no one knows how they will respond to this continued fast-paced news cycle and jarring political decisions that are rapidly being made and changed. Unpredictability and fear continue to grip the financial institutions making decisions about fiscal policy, leaving many people confused and worried about the direction the country is headed.